Lifetime allowance

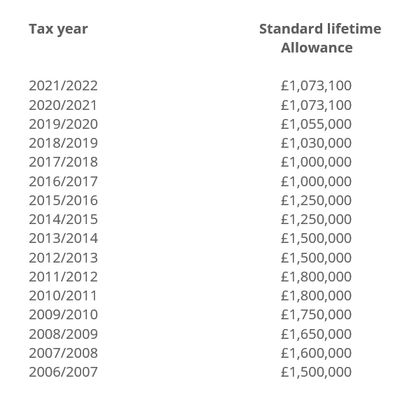

The current standard LTA is 1073100. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge.

What Is The Lifetime Allowance

Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026.

. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. If you take the excess as a lump sum its taxed at 55. This is the total amount you can.

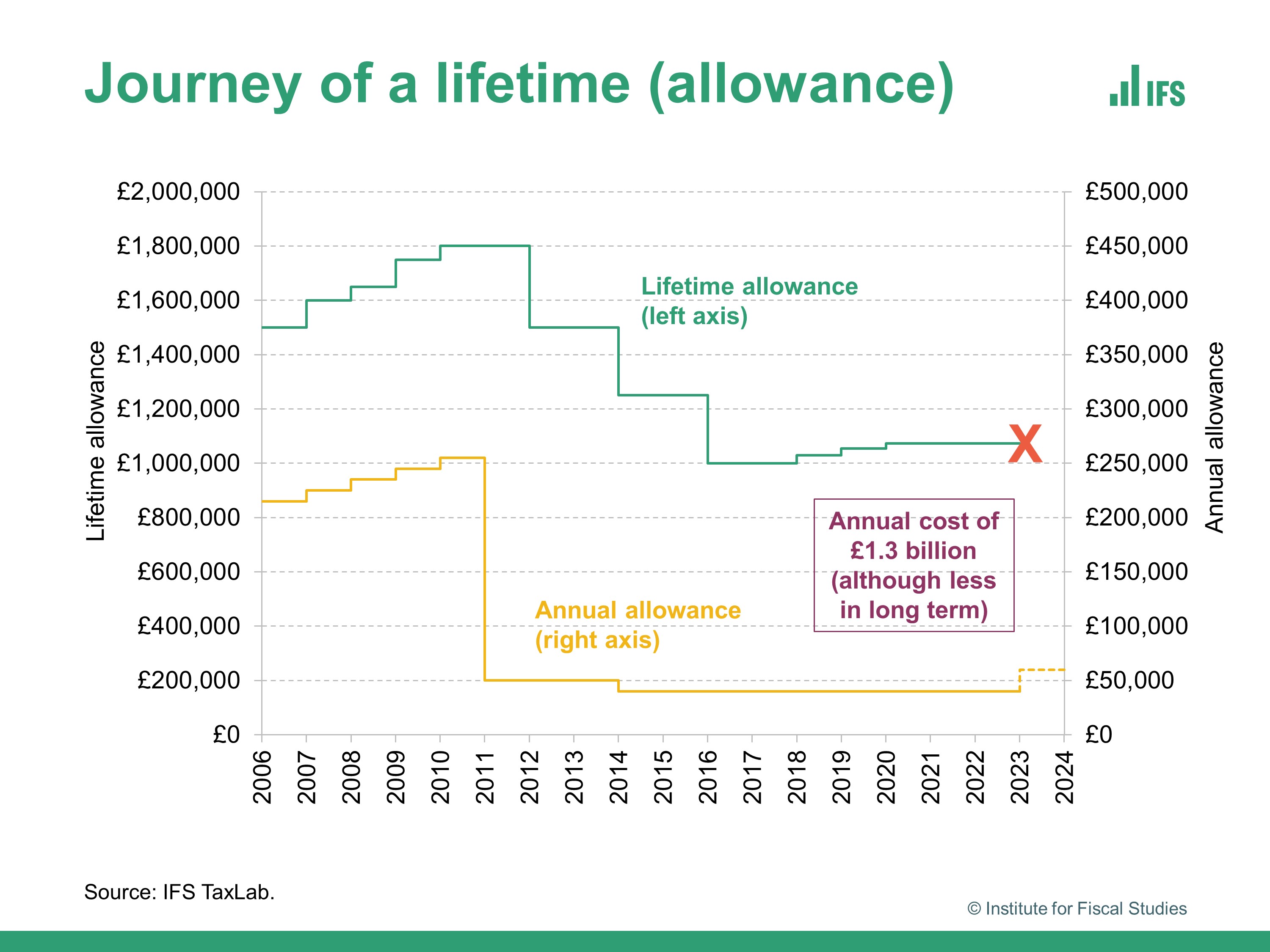

Individuals whose total UK tax relieved pension savings are. Your pension provider or administrator should deduct. Web 2 days agoAs part of his Spring Budget announced today March 15 the chancellor said the lifetime allowance will be scrapped to encourage people to stay in work longer.

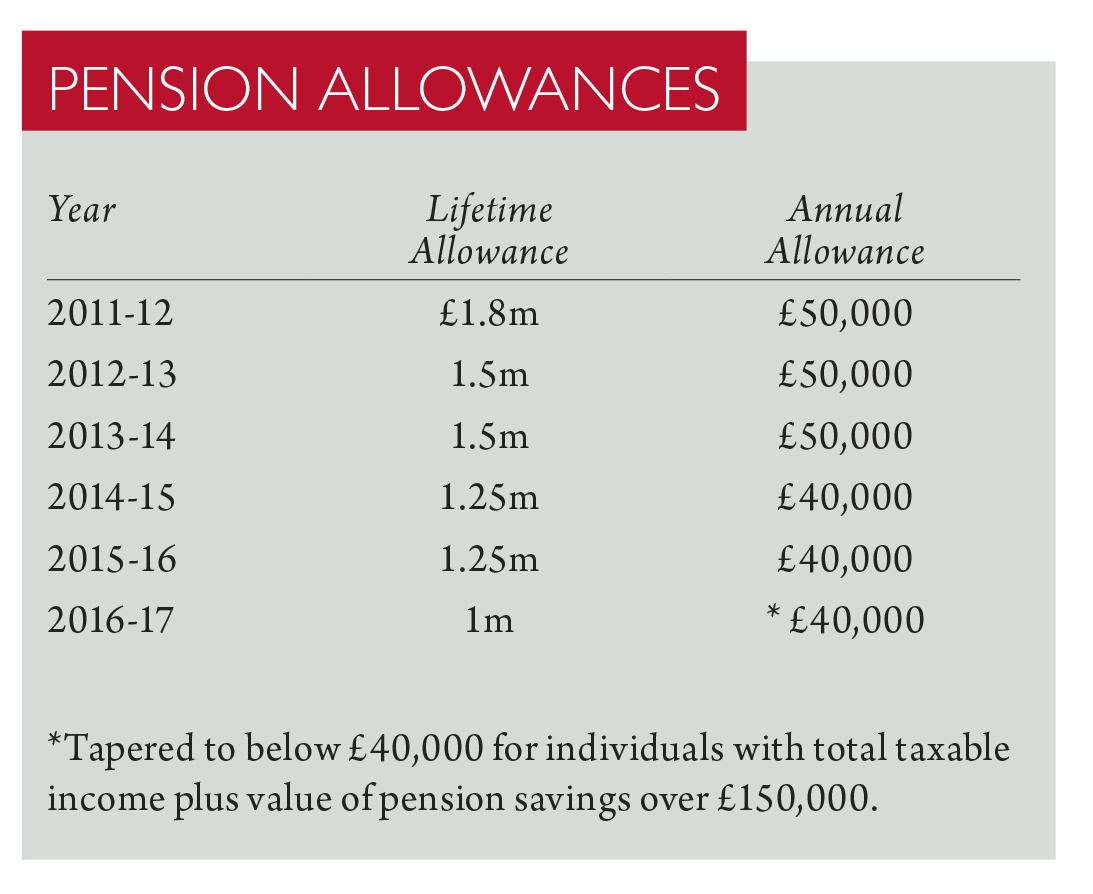

Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected. Web The lifetime allowance is the total amount of money you can build up in a workplace defined benefit pension scheme and savings in a defined contribution pension. Web Your pension lifetime allowance is 40000 per annum.

The current pension lifetime allowance is 1073100 for the 20212022 tax year. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. The other is the annual allowance and.

Web The lifetime allowance is the total value of all pension benefits you can have without triggering an excess benefits tax charge. Web 1 day agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Over the average lifetime it refers to the projected value of your pensions excluding your state pension.

Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. Web The lifetime allowance LTA on tax-free pension savings will rise as well as the 40000 cap on annual pension contributions the Daily Mail reported citing. The lifetime allowance limit 202223 The 1073100 figure is set by.

Web How much is the lifetime allowance. Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. Web Another myth surrounding the lifetime allowance is that it tends to only be a concern for people approaching retirement but thats not always the case. Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits.

Each time you take payment of a pension you use up a percentage of. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here. It means people will be allowed to put.

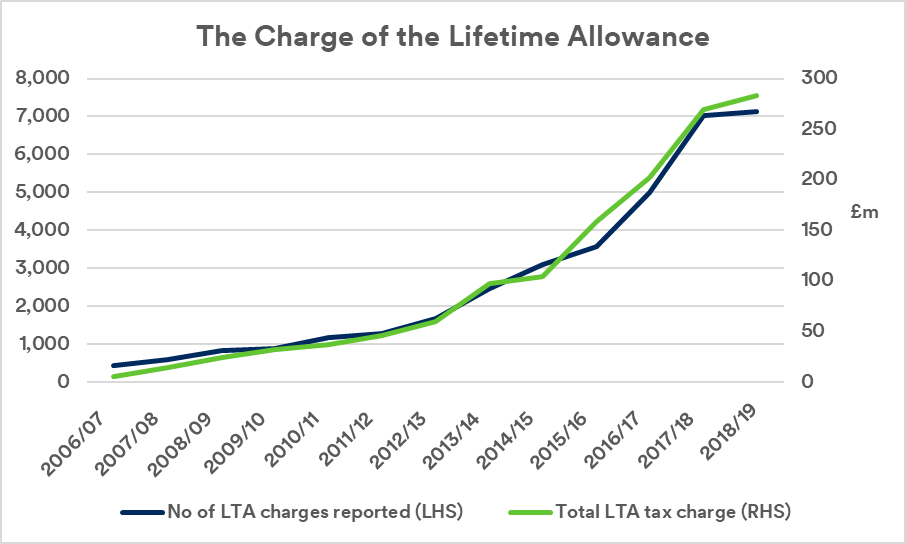

The chart below shows the history of the lifetime allowances. Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply.

Benefits are only tested. Web Charges if you exceed the lifetime allowance Lump sums. Web The Lifetime Allowance LTA is the overall amount of pension savings that you can have at retirement without incurring a tax charge.

Check lifetime allowance Annual allowance.

Pensions Lifetime Allowance Devaluation Continues Jackson Toms

The Lifetime Allowance Lgps

What Is The Pension Lifetime Allowance Nuts About Money

What Is The Pension Lifetime Allowance And How Does It Work Unbiased Co Uk

Lifetime Allowance Finsgate

Totprcmjn9u89m

2kmb70qzu7lxbm

1uuqbdv2buutum

Annual And Lifetime Pension Allowances Taxation

Could It Pay To Breach The Pensions Lifetime Allowance Shares Magazine

Pension Lifetime Allowance Cuts On The Horizon

1 Tuyu8dveizwm

Should I Stop Paying Into My Pension If It Exceeds The Lifetime Allowance Atticus Financial Planning

How Will The Lifetime Allowance Affect My Uk Pension If I Live Overseas Sjb Global Financial Pension Experts

How To Limit The Lifetime Allowance Tax Charge On Your Pension Wealth And Tax Management

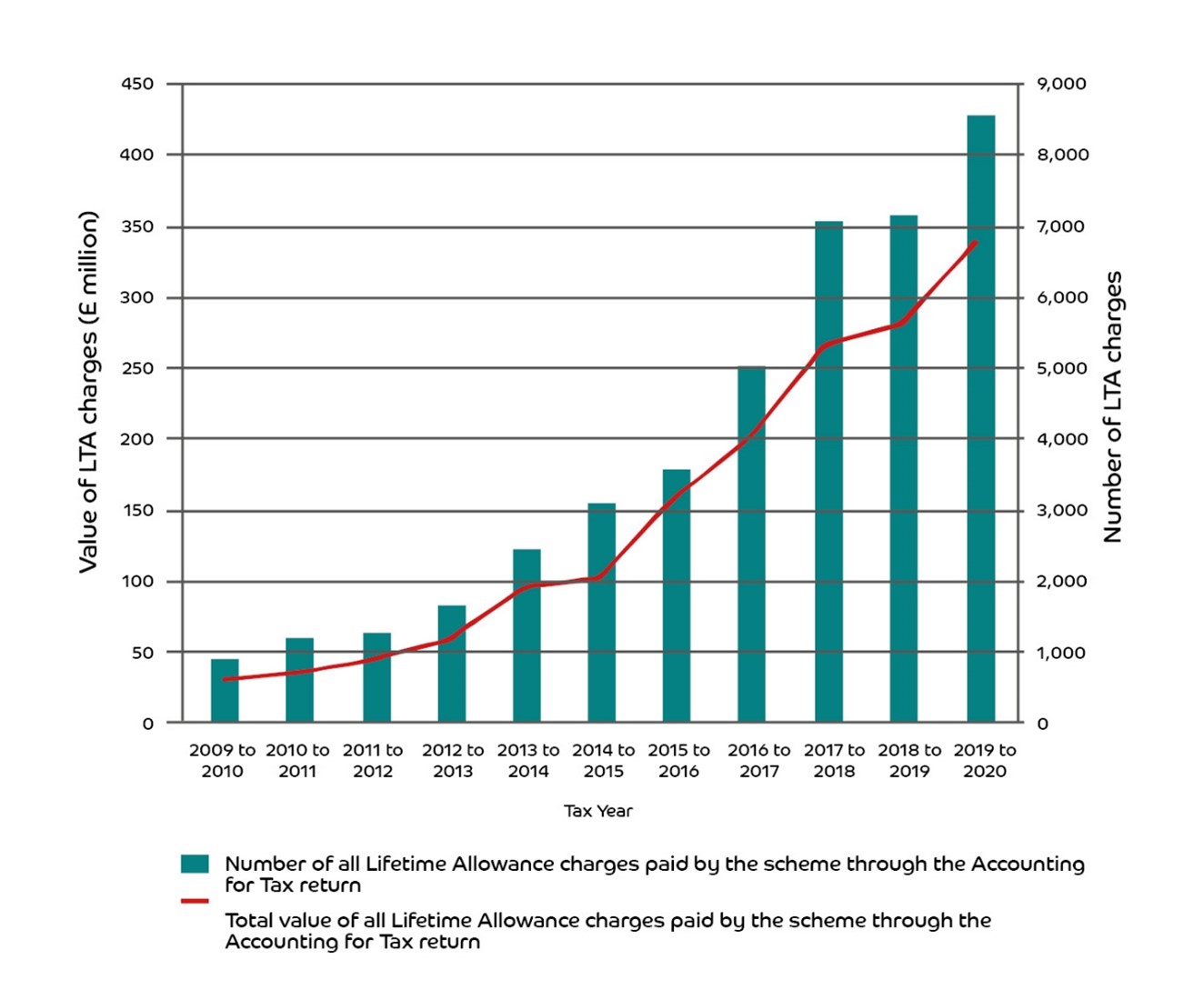

Pension Lifetime Allowance Tax Take Jumps By Over 1 000

Pension Lifetime Allowance Explained St James S Place