Stock gains calculator

You can also start from the. Calculate what you may owe with Personal Capitals capital gains tax calculator.

Common Stock Formula Calculator Examples With Excel Template

Capital Gain Tax Calculator for FY19.

. How Do You Calculate Gain or Loss Percentage on Stock With a Calculator. Investments can be taxed at either long term. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

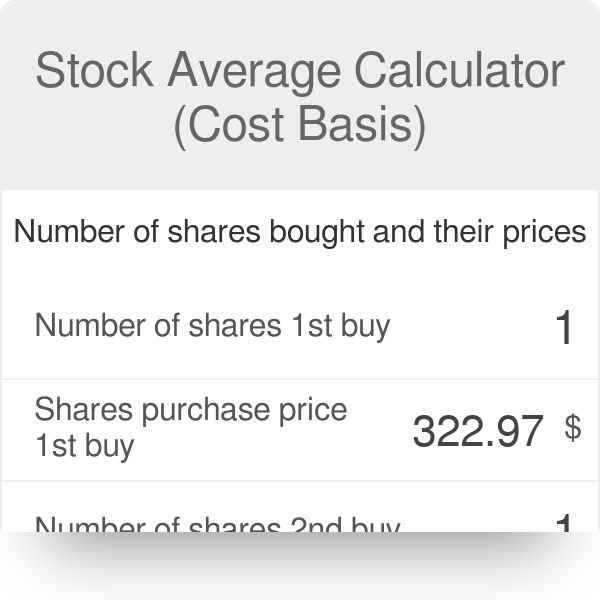

Youll need the original purchase price and the current value of your stock in order to make the. Three Cutting-Edge Platforms Built For Traders. This stock cost basis calculator helps you find your average buy price.

Add multiple results to a. Finds the target price for a desired profit amount or percentage. Must be a valid phone.

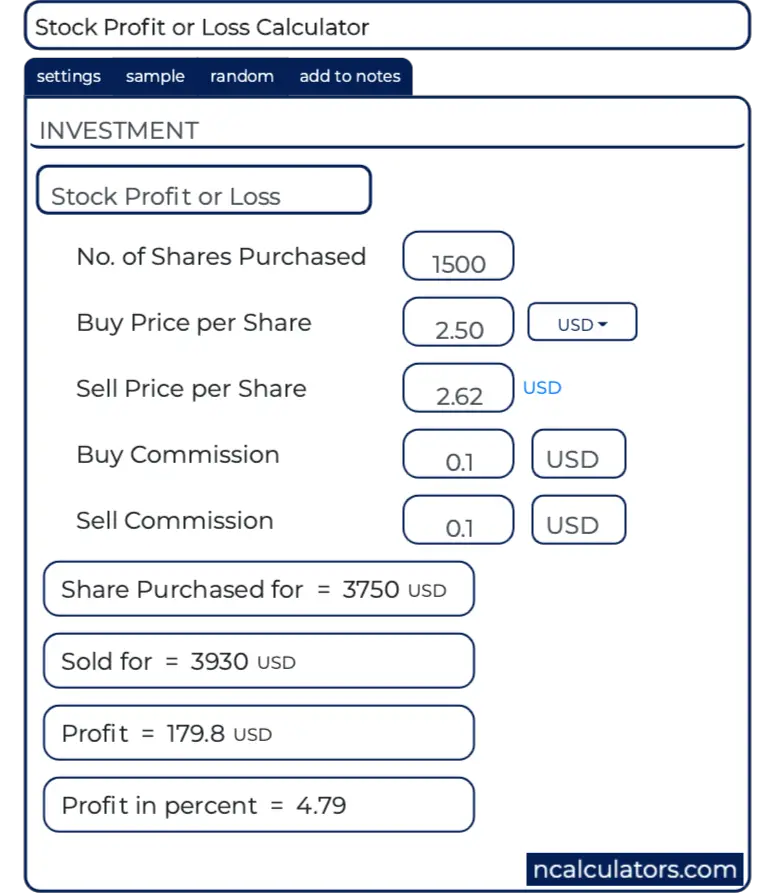

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the. 2021 capital gains tax calculator. Hard 14 MasterMind Group.

Bear Market Survival Guide MasterMind Group. Also if a taxpayer held common stock with a 0001 tax basis per share and preferred stock with a 1000 tax basis per share the taxpayer could sell some of the common. Our stock profit calculator will assist you in managing your risk-to-reward ratio by calculating your return on investment.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status. Capital Gains Tax Calculator.

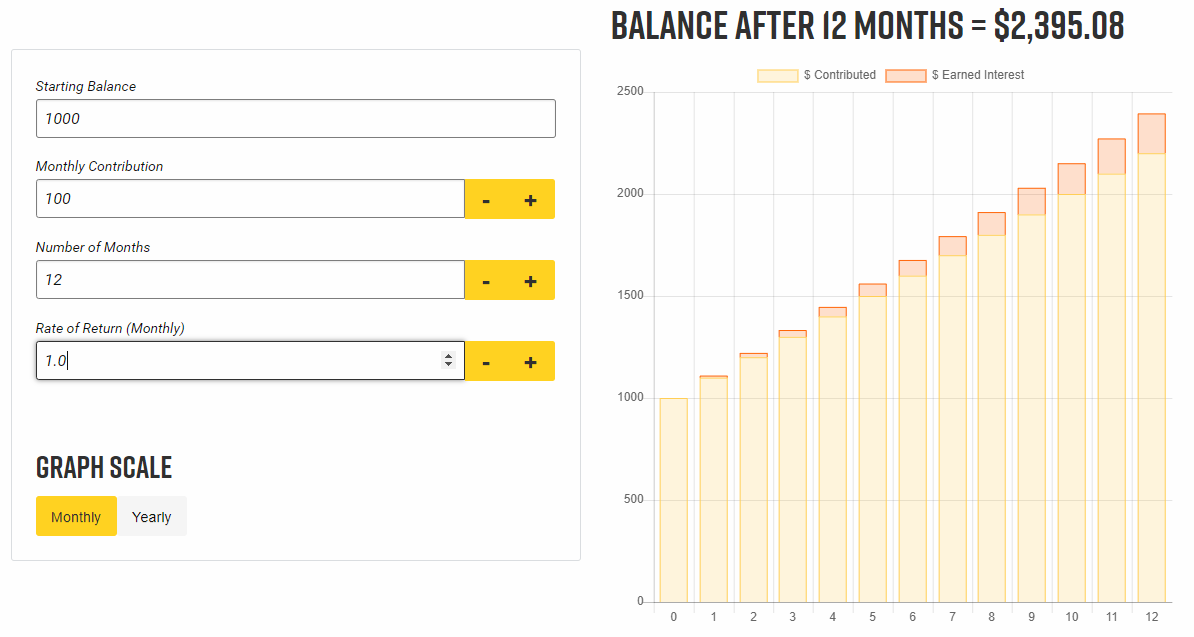

You can determine the optimal initial investment by entering the. Tackle 25 MasterMind Group. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much.

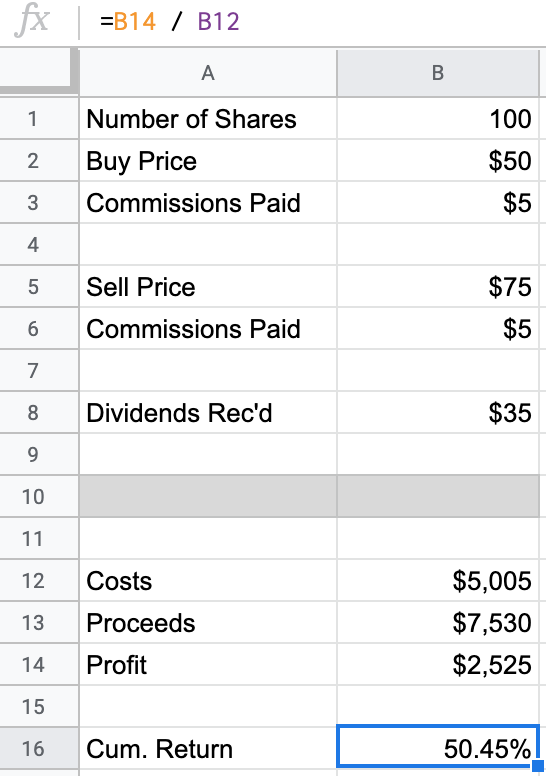

A calculator to quickly and easily determine the profit or loss from a sale on shares of stock. The first step in calculating gains or losses is to determine the cost basis of the stock which is the price paid plus any associated commissions or fees. Each time you click Calculate it factors in your previous buy or sell transactions.

Just follow the 5 easy steps below. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad Power Your Trading with thinkorswim.

Password must be 8-64 characters. Capital Gains Tax Calculator Estimate your capital gains taxes If youve purchased and sold capital assets such as stocks or cryptocurrencies then you might owe taxes on the positive. Must be a valid email address.

The Stock Calculator is very simple to use. Lets get started today. Ad Were all about helping you get more from your money.

Cash Flow Condors MasterMind Group. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. New Tax Laws Recently there has.

2022 capital gains tax rates.

Stock Total Return And Dividend Calculator

How To Calculate Stock Profit Abstractops

Capital Gains Tax Calculator For Relative Value Investing

Stock Average Calculator Cost Basis

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains 101 How To Calculate Transactions In Foreign Currency

How To Calculate Stock Profit Abstractops

Common Stock Formula Calculator Examples With Excel Template

Stock Profit Or Loss Calculator

Capital Gain Formula Calculator Examples With Excel Template

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube

Stock Calculator

Capital Gain Formula Calculator Examples With Excel Template

Common Stock Formula Calculator Examples With Excel Template

Capital Gains Tax Calculator For Relative Value Investing

Compounding Gains Calculator Tackle Trading

How To Calculate Stock Profit Abstractops